- Call/Text: 850.987.HOME(4663)

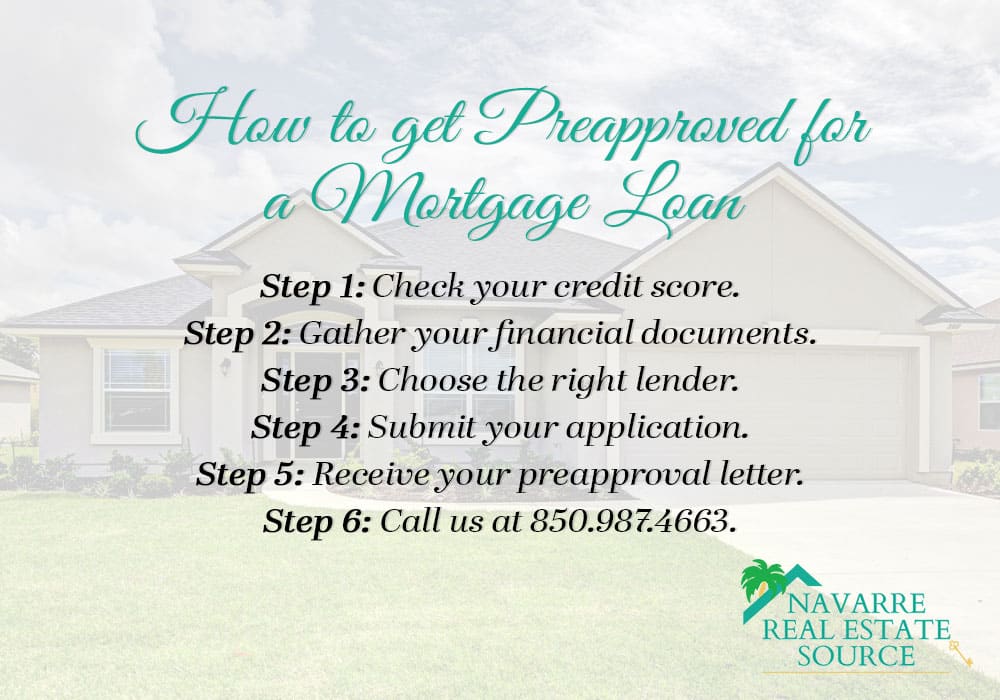

How to Get Preapproved for a Mortgage Loan: The Do’s and Don’ts

Securing a mortgage loan preapproval is a pivotal step in the home buying process.

Securing a mortgage loan preapproval is a pivotal step in the home buying process.

It not only gives you a clear understanding of your budget but also makes you an attractive buyer to sellers. In this comprehensive guide, we’ll walk you through the process of getting preapproved for a mortgage loan, highlight key dos and don’ts, and introduce you to local lenders in Navarre. Plus, we’ll show you how Navarre Real Estate Source’s team of agents can assist you in finding the perfect home in Navarre.

What is Mortgage Loan Preapproval?

Mortgage loan preapproval is an assessment by a lender that determines how much you are qualified to borrow before you even start house hunting. This involves a thorough evaluation of your financial status, including your credit score, income, assets, and debts.

Importance of Mortgage Loan Preapproval

Getting preapproved for a mortgage loan offers several benefits:

- Budget Clarity: Knowing your borrowing limit helps narrow down your home search.

- Stronger Offers: Sellers are more likely to consider offers from preapproved buyers.

- Faster Closing: With preapproval, the loan process can move more quickly once you find a home.

The Dos and Don’ts of Getting Preapproved for a Mortgage Loan

-

The Dos

- Do Check Your Credit Score: Before applying for preapproval, obtain your credit report and score. A higher credit score can lead to better loan terms.

- Do Gather Financial Documents: Prepare essential documents such as tax returns, pay stubs, bank statements, and proof of assets. Lenders will require these to verify your financial stability.

- Do Compare Lenders: Different lenders offer varying interest rates and terms. Shop around to find the best deal.

- Do Get Preapproved Early: Getting preapproved before you start house hunting gives you a clear idea of your budget and strengthens your offer.

-

The Don’ts

- Don’t Make Major Financial Changes: Avoid significant financial changes such as job switches or large purchases, as they can impact your creditworthiness.

- Don’t Apply for New Credit: Refrain from opening new credit accounts during the preapproval process to avoid negatively affecting your credit score.

- Don’t Hide Financial Information: Be transparent about your financial situation. Lying or hiding information can lead to denial of your loan.

Why Work with Navarre Real Estate Source’s Team?

After securing preapproval, the next step is finding your dream home. Navarre Real Estate Source’s team of experienced agents can help you navigate the local market. Their deep knowledge of the Navarre area ensures you’ll find a home that meets your needs and budget.

Frequently Asked Questions

- What is the difference between prequalification and preapproval? Prequalification gives you an estimate of how much you can borrow, while preapproval involves a more thorough evaluation of your finances and provides a conditional commitment from the lender.

- How long does the preapproval process take? The preapproval process typically takes a few days to a week, depending on how quickly you can provide the necessary documents.

- How long is a mortgage preapproval valid? A mortgage preapproval is usually valid for 60 to 90 days. After that, you may need to update your financial information with the lender.

- Can I get preapproved with bad credit? Yes, you can still get preapproved with bad credit, but your loan options may be limited, and you may face higher interest rates.

- What happens if my financial situation changes after preapproval? If your financial situation changes, such as a job loss or a significant new debt, inform your lender immediately, as it could impact your preapproval status.

- How can Navarre Real Estate Source help after I get preapproved? Navarre Real Estate Source’s team can assist you in finding the perfect home in Navarre, leveraging their local expertise and market knowledge to ensure a smooth home buying process.

Local Lenders in Navarre, Florida

When seeking preapproval, consider working with local lenders who understand the Navarre market:

Getting preapproved for a mortgage loan is a vital step in the home buying journey. By following the dos and don’ts outlined in our guide and working with local lenders in Navarre, you can streamline the process and position yourself as a strong buyer. Once preapproved, Navarre Real Estate Source’s team of agents can help you find the perfect home in this beautiful coastal community!

Explore Luxury Living at 2552 1st Court, Navarre, FL 32566

If you’re on the hunt for a luxurious home in Navarre, FL, 2552 1st Court is a property that demands your attention. Located in the exclusive Hidden Creek subdivision (located in Holly By the Sea), this residence offers an exceptional combination of elegance, space, and modern comforts. Priced at $579,999, this 4-bedroom, 3-bathroom home is a standout in the market, ideal for families and individuals seeking a high-quality living experience.

Prime Location and Community

One of the most appealing aspects of 2552 1st Court is its location. Hidden Creek is known for its peaceful ambiance, friendly community, and proximity to essential amenities. Navarre itself is a vibrant town famous for its stunning beaches, excellent schools, and community spirit. This property places you just minutes away from the beautiful Navarre Beach, a variety of dining options, shopping centers, and recreational facilities. Whether you’re a nature lover, a foodie, or enjoy a day of shopping, you’ll find everything you need within a short drive.

Spacious and Elegant Design

This contemporary single-family home boasts a generous 2,927 square feet of living space. Built in 2001, it sits on a spacious 0.67-acre lot, providing plenty of room for outdoor activities and potential landscaping projects. The house is designed with both aesthetics and functionality in mind, featuring 10-foot high ceilings that contribute to its open and airy feel. The design and layout make it perfect for hosting gatherings and family events.

Inviting Living Spaces: Upon entering, you’re greeted by a grand living room that sets the tone for the rest of the house. The living area is accentuated by large windows that flood the space with natural light, creating a warm and welcoming atmosphere. The centerpiece of the living room is a cozy wood-burning fireplace, ideal for creating a relaxing environment during cooler months. This space is perfect for family gatherings or unwinding after a long day.

Gourmet Kitchen For those who love to cook, the kitchen at 2552 1st Court will be a delight. It features modern appliances, ample counter space, and plenty of storage options. The kitchen flows seamlessly into the dining area, making it convenient for entertaining guests. Whether you’re preparing a quick breakfast or hosting a dinner party, this kitchen is equipped to handle all your culinary needs.

Master Suite Retreat The master suite is designed to be a sanctuary of comfort and luxury. The spacious bedroom offers plenty of room for a king-sized bed and additional furniture. The en-suite bathroom enhances the luxurious feel with a soaking tub, a separate shower, and dual vanities. A large walk-in closet provides ample space for your wardrobe, making it easy to keep everything organized.

Additional Bedrooms and Flex Spaces In addition to the master suite, the home includes three more bedrooms, each generously sized to ensure comfort and privacy for family members and guests. One of the standout features of this property is its dedicated office space, perfect for those who work from home or need a quiet place to study. There’s also a flex room that can be customized to suit your needs—whether you envision a playroom, a gym, or an additional living area.

Outdoor Living

The outdoor space at 2552 1st Court is just as impressive as the interior. The large backyard offers endless possibilities, from creating a garden oasis to setting up a play area for children. The property also features a three-car garage and a spacious driveway, ensuring ample parking for residents and visitors alike.

Modern Conveniences

This home is equipped with all the modern amenities to ensure a comfortable living experience. Central heating and cooling keep the temperature just right year-round, while updated fixtures and high-quality finishes add a touch of elegance to every room. The community itself offers a range of local amenities, including parks, golf courses, and organized community events, fostering a sense of belonging and engagement.

Your Dream Home Awaits

2552 1st Court in Navarre, FL, is more than just a house—it’s a place where you can create lasting memories. With its prime location, spacious design, and luxurious features, it offers everything you need for a comfortable and fulfilling lifestyle. Whether you’re looking for a family home, a place to retire, or an investment property, this home ticks all the boxes. Don’t miss out on the opportunity to own this beautiful property in one of Navarre’s most desirable neighborhoods.

For more information or to schedule a viewing, visit the listing and take the first step towards making this dream home yours.

Featured Property: 7472 Sunset Harbor Dr

Nestled along the serene shores of Navarre, Florida, lies a hidden gem waiting to be discovered. Welcome to 7472 Sunset Harbor Dr, a waterfront oasis offering tranquility and coastal charm. Let’s take a closer look at what makes this property a dream come true for those looking the perfect blend of luxury and relaxation in Navarre.

Property Overview

Situated in the prestigious Sunset Harbor condominium community, this meticulously maintained residence boasts breathtaking views of the Santa Rosa Sound. With 3 bedrooms, 2 bathrooms, and an open-concept living area, this home provides plenty of space for both relaxation and entertainment. Step inside to discover modern finishes, abundant natural light, and a layout designed for effortless coastal living.

Amenities and Features

From the moment you arrive, you’ll be captivated by the array of amenities that enhance the lifestyle at 7472 Sunset Harbor Dr. Enjoy lazy afternoons by the sparkling waterfront pool, unwind in the hot tub, or launch your kayak for a scenic paddle along the sound. With a private balcony, every day feels like a vacation in Navarre.

Location Highlights

Conveniently located just minutes from Navarre Beach, this property offers easy access to pristine white sands and emerald waters. Spend your days soaking up the sun, fishing off the pier, or exploring the nearby Gulf Islands National Seashore. With dining, shopping, and entertainment options just a short drive away, you’ll have everything you need right at your fingertips. View our list of local attractions.

Why You’ll Love Living Here

Whether you’re seeking a peaceful retreat or a year-round residence, 7472 Sunset Harbor Dr offers the perfect combination of comfort and convenience. Imagine waking up to panoramic water views, sipping your morning coffee on the balcony, and ending each day with a spectacular sunset over the sound. This is more than a home – it’s a lifestyle, and we have the real estate agents to make your dream a reality.

Experience the best of waterfront living at 7472 Sunset Harbor Dr, where luxury meets coastal charm in the heart of Navarre, FL. Don’t miss your chance to make this stunning property your own and start living the life you’ve always dreamed of. Schedule a showing today and prepare to fall in love with everything this waterfront oasis has to offer.

Ready to make 7472 Sunset Harbor Dr your new home?

Contact Navarre Real Estate Source today to schedule a private tour and discover the magic of waterfront living in Navarre, FL.

Family-Friendly Fun: Why Navarre, FL, is Perfect for Your Next Home

Nestled along the stunning Emerald Coast is Navarre, Florida, offering a perfect blend of natural beauty, small-town beach spirit, and family-friendly attractions. If you’re considering relocating to this picturesque paradise, you’re in for a treat. Here’s why Navarre is the ideal destination for your next family home, with nearby attractions in Fort Walton, Pensacola, and Destin.

Local Area Attractions

- Pristine Beaches: Sink your feet into the soft, sugar-white sands and soak up the sounds of the crashing waves. Navarre boasts some of the most pristine beaches in Florida (and the world). Families can enjoy endless days of fun in the sun, building sandcastles, swimming, and soaking up breathtaking Gulf views. Nearby, Fort Walton Beach, Pensacola Beach, and Destin offer equally beautiful shores, perfect for family beach outings and water activities.

- Outdoor Adventures: From kayaking along the tranquil Santa Rosa Sound to hiking through the scenic Navarre Beach Marine Park, outdoor enthusiasts will find no shortage of adventures in Navarre. Families can also explore the natural beauty of places like Fort Walton’s Okaloosa Island and Pensacola’s Gulf Islands National Seashore. In Destin, thrilling activities such as dolphin cruises, parasailing, and snorkeling await adventurous families at every turn.

- Top-Rated Schools: Navarre is home to excellent schools, making it an ideal location for families with children. Nearby communities like Fort Walton Beach, Pensacola, and Destin also offer quality educational options, ensuring that children receive a well-rounded education in a supportive environment. Not sure which area is the best for your schooling needs? Let us help you navigate the home search!

- Community Events and Festivals: Throughout the year, Navarre and its neighboring towns host a variety of community events and festivals. From Pensacola’s Blue Angels Air Show to Destin’s HarborWalk Village events, there’s always something exciting happening nearby. These events provide opportunities for families to come together, have fun, and create lasting memories.

- Family-Friendly Attractions: Navarre offers an assortment of family-friendly attractions, and nearby towns add even more to the mix. Families can visit attractions like Fort Walton’s Gulfarium Marine Adventure Park, Pensacola’s National Naval Aviation Museum, and Destin’s Big Kahuna’s Water & Adventure Park for unforgettable experiences and endless entertainment.

With its pristine beaches, outdoor adventures, top-rated schools, community events, and family-friendly attractions, Navarre, FL, is the perfect place to call home for families seeking a blend of coastal charm and small-town hospitality. And with Fort Walton, Pensacola, and Destin just a short drive away, the possibilities for family fun are endless. Start your journey to homeownership in Navarre today and create lasting memories with your loved ones along the beautiful Emerald Coast.

Current Featured Properties

IDX MLS IDX Listing Disclosure © 2024

All information is believed to be accurate but is not guaranteed. Protected by Copyright© 2020 and is owned either by the Emerald Coast Association of REALTORS®, Inc or by the developers of the software, FBS, Inc. All rights reserved.

Homeowner Associations (HOAs): The Good and the Bad

Residing in Navarre, Florida, offers a picturesque lifestyle many aspire to, with the choice of neighborhood playing a pivotal role in fulfilling this dream. One critical consideration is the potential involvement in a Homeowners Association (HOA). The benefits and challenges of living within an HOA-governed community are significant, making it essential to understand what an HOA entails.

Understanding the Role of an HOA in Your Home-ownership

An HOA serves as a governing body for a community, typically managed by a board of directors elected from amongst the residents. Here’s an overview of their primary responsibilities:

- Rule Enforcement and Setting: HOAs implement Covenants, Conditions, and Restrictions (CC&Rs), governing aspects from parking norms and landscaping to pet regulations and exterior home designs.

- Maintenance of Common Areas: The association ensures the upkeep of communal facilities such as parks, pools, and clubhouses, including landscaping, waste management and debris removal.

- Dispute Resolution: Conflicts between neighbors over property boundaries, noise complaints, or other issues can arise in any community. HOAs typically provide mediation services or set guidelines for dispute resolution, offering an organized and impartial platform to address and resolve such issues. This structured approach to conflict resolution can help maintain harmony within the community and prevent minor disagreements from escalating.

- Fee Collection: The dues required by an HOA help with the cost of the maintenance of shared spaces, amenities, and the operational costs of the HOA itself.

Advantages of HOA Community Living

- Property Value Preservation: HOAs play a critical role in maintaining and even increasing the value of homes within the community through strict rules for aesthetics and structural standards. This uniformity ensures that individual actions or neglect do not poorly reflect the overall appearance or value of the neighborhood. Homeowners are often willing to pay a premium for properties within well-managed HOA communities, recognizing the long-term benefits of such governance.

- Well-Maintained Common Areas: HOAs ensure that shared spaces remain in pristine condition, reflecting positively on the neighborhood. This includes well manicured landscapes, clean recreational areas and timely renovations as needed. HOAs provide a more enjoyable neighborhood for homeowners and foster a sense of community pride and togetherness.

- Access to Amenities: Residents of HOA communities enjoy exclusive amenities such as swimming pools, state-of-the-art fitness centers, and recreational facilities.

These expanded benefits illustrate the multifaceted role HOAs play in enhancing the living experience within a community, offering a mix of aesthetic, recreational, security, and social advantages that contribute to a high quality of life for their residents.

Challenges of HOA Community Living

- Fees and Restrictions: HOAs charge monthly or annual fees to cover the maintenance of common areas and amenities, and these fees can be substantial depending on the range and quality of amenities offered. Additionally, there may be assessments for major projects or repairs. The financial burden doesn’t stop at fees; the restrictions imposed by HOAs on exterior home modifications can necessitate additional spending to comply with community standards. From the paint color to landscaping choices and even the type of mailbox or exterior decorations allowed, these rules can feel overly restrictive and lead to increased homeowner expenses.

- Risk of Conflicts: Differences in opinion between homeowners and the HOA board, or amongst neighbors, can lead to disputes with longer timelines to resolution.

- Reduced Autonomy: The CC&Rs (Covenants, Conditions, and Restrictions) can govern everything from the color of your house to the type of fencing allowed or even the placement of satellite dishes. This can be particularly frustrating for homeowners who value individual expression through their property or who wish to make eco-friendly upgrades that conflict with HOA guidelines, such as installing solar panels or xeriscaping. The process of seeking approval for changes can be cumbersome, discouraging homeowners from making desired modifications.

Understanding these challenges is crucial for prospective and current HOA community members alike. While the benefits of such communities are significant, weighing them against the potential downsides is essential for making informed decisions about where to live.

Making an Informed Decision

The decision to live in an HOA-governed community largely depends on individual preferences. If the benefits of a well-kept neighborhood, access to amenities, and enhanced property values align with your expectations, an HOA community could be a perfect match. Conversely, if you prioritize greater control over your property and fewer restrictions, a non-HOA community may suit you better.

Let Navarre Real Estate Source Guide You

Navarre Real Estate Source is here to help you find your ideal home in Navarre, whether it falls within an HOA community or not. Our expertise in the local real estate market ensures we align your living preferences with the right community. Reach out to us today to take the next step towards achieving your real estate objectives in Navarre.

Understanding Your Homeowners Association (HOA)

In the world of real estate, the term “HOA” often surfaces, carrying implications for homeowners and potential buyers alike. Homeowners Associations play a crucial role in shaping the character and dynamics of a neighborhood or community. Let’s dive into what an HOA entails and why trusting Navarre Real Estate Source can be a game-changer in navigating the path to homeownership.

Unveiling the HOA

What is an HOA?

A Homeowners Association is a private entity formed within a residential community to oversee and manage shared spaces and amenities. These associations are comprised of homeowners who, upon purchasing property within the community, become members of the HOA. Membership entails the responsibility of following to the association’s rules and contributing to the common fund through annual or monthly fees.

Maintaining Aesthetic Harmony and Community Standards

One of the primary functions of an HOA is to uphold and enforce community rules and architectural guidelines. These rules often pertain to the appearance of homes, yard maintenance, and other factors that contribute to the overall aesthetic harmony of the community. This commitment ensures that the community retains a cohesive and appealing atmosphere, thereby safeguarding property values.

Examples include: placement of trashcans, RV/Camper storage, fencing or even the color of your home.

Preserving Property Values and Enhancing Amenities

HOAs actively work to preserve property values by maintaining common areas such as parks, pools, and landscaping. The association’s involvement extends to organizing community events, addressing homeowner disputes, and managing the financial aspects of the community. This proactive approach contributes to an enriched living experience and fosters a sense of community among residents.

Navarre Real Estate Source: A Guiding Light

Navigating the HOA Landscape

Understanding the intricacies of an HOA is crucial for prospective homebuyers. Here’s where the expertise of a trusted real estate agent with Navarre Real Estate Source comes into play. Our agents serve as a knowledgeable guide, helping you navigate the landscape of HOAs by providing insights into the specific rules and regulations of a community.

Thorough Review of CC&R Documents

Navarre Real Estate Source will assist you in thoroughly reviewing the Covenants, Conditions, and Restrictions (CC&R) documents associated with the HOA prior to the purchase of your home. These documents outline the rules, standards, and obligations imposed on homeowners. A comprehensive understanding of these regulations ensures that you make an informed decision aligned with your lifestyle and preferences.

Negotiating the Best Terms

With a trusted agent by your side, you gain an advocate who can negotiate favorable terms within the confines of the HOA rules. This includes understanding fee structures, potential restrictions, and ensuring that the community aligns with your vision of a perfect home.

With our invaluable local knowledge, we can provide insights into the reputation and functioning of various HOAs in the area, helping you make an informed choice about where to establish your home.

A Collaborative Journey

In conclusion, understanding the role of an HOA is pivotal in making informed decisions about homeownership. Trusting our team elevates this process into a collaborative journey. With our expertise, you can confidently navigate the complexities of HOAs, ensuring that your chosen neighborhood aligns seamlessly with your lifestyle. Embrace the guidance of Navarre Real Estate Source, and embark on the path to a harmonious and fulfilling homeownership experience.

Recent Reviews for Navarre Real Estate Source

As agents at Navarre Real Estate Source, we take great pride in delivering exceptional customer service and meaningful interactions. Recognizing that buying or selling a property can often be a demanding endeavor, our aim is to streamline the process for you. Below, we’ve gathered a selection of testimonials from our recent satisfied clients.

[Tara] She is beyond amazing as a real state agent and helped my husband and I find our dream home here in Florida while we were stationed in the UK. She was thorough for every single house we wanted to view and worked long hours for weeks because we were on a time crunch. We scheduled my flight for the day of closing and she even picked me up from the airport. Being military, we might have to move again but even then, we will 1000% be using Navarre Real Estate Source (specifically Tara) to manage our property while we’re gone. 10/10 couldn’t recommend enough. – I.M.D

If you are looking into real estate agents in the Navarre area, then you probably are already familiar with “Florida’s best kept secret.”

If you are wanting to relocate and be part of that secret then it’s time you learned the Second best kept secret – Shannon Mills at Navarre Real Estate Source and her partnership (Dream team!) with Stacy Dempsey at New American Funding.

Shannon was there from the very first call all the way to the handing off the keys. Each step of the way Shannon ensured an exceptional experience while relentlessly pursuing value for her clients. We were truly fortunate to be one of them. Her tenacity, expertise, and attention to detail allowed us to land in the place and home of our dreams. She really took the stress out of the situation for our family and would certify that she can do the same for yours.

If you are considering a move, on the fence, or even remotely curious – I highly recommend starting here. You are likely to have go no further or anywhere else to have a smooth and pleasant home-buying experience. Many thanks to you Shannon! – Joe I.

Navarre Real Estate Source provided a great deal of detail in their recommendations for me pertaining to renovations of my property before starting the process of selling my home. Very thankful I chose this company to represent me during my sale and will be using them for future transactions. They went above and beyond by staging the property with furniture for the pictures prior to listing, which assisted greatly in expediting the sale. They provided a lot of stress relief during this process, because of their consistent and prompt communication. Shannon and Tara are excellent at their craft and exceeded my expectations! – Israel T.

Tips to Buying a Home

Purchasing a new home in the picturesque Navarre, Florida, is a thrilling step, yet it demands a well planned approach. Here are 10 great tips to help you along your path, along with insights into various loan types that can transform your homeownership dreams into reality.

- Assess Your Budget: Begin by taking an honest look at your financial situation. Calculate your monthly income, expenses, and existing debts to determine a comfortable price range for your new home. This first and foundational step sets the stage for the entire process.

- Research Loan Types: Familiarize yourself with the array of loan types available. For example, Fixed-Rate Mortgages offer consistent monthly payments, while Adjustable-Rate Mortgages come with fluctuating interest rates.

Federal Housing Administration (FHA) Loans require low down payments, making them suitable for first-time buyers. While veterans can explore VA Loans for exclusive benefits, including no down payment and lower interest rates.

- Get Pre-approved: Seek a mortgage pre-approval early in the process. This not only grants you a clear understanding of the loan amount you qualify for but also helps your negotiating power with sellers. Pre-approval expedites the buying journey and showcases your seriousness to potential sellers.

- Credit Check: Delve into your credit score’s details. A healthy credit score is one of the most important things for favorable loan terms. Address any errors on your credit report and take steps to improve your score if needed, ensuring you qualify for better interest rates and loan options.

During your home buying process, it is important to not make any large purchases or open any additional lines of credit, doing so can result in being denied a home loan.

- Down Payment: Evaluate your down payment options. Although the traditional 20% down payment is customary, several loan programs allow for a lower percentage. FHA Loans, for instance, necessitate as little as 3.5% down. Explore down payment assistance programs in Navarre that might provide financial aid.

- Loan Terms: Decide on the loan term that aligns with your financial strategy and goals. A shorter loan term, such as 15 years, generally comes with higher monthly payments but lower interest rates. Longer terms, like 30 years, offer lower monthly payments but accumulate more interest over time.

Did you know making an additional loan payment per a year can shorten your term by 4-5 years?

- Compare Lenders: Devote time to researching multiple lenders. Obtain loan quotes from various sources, meticulously comparing factors such as interest rates, closing costs, and customer feedback. This diligent research can save you substantial money over the life of your loan.

- Interest Rates: Stay informed about fluctuating interest rates. Even a slight change in interest rates can significantly impact your monthly payments and the overall affordability of your new home. By working closely and planning with your lender, you can keep an eye on market trends and lock in a rate if they are favorable.

- Understand Closing Costs: Beyond the home’s price tag, remember that closing costs are a substantial component of your home purchase. These can encompass appraisal fees, title insurance, origination fees, and more, typically ranging from 2% to 5% of the home’s value. Be financially prepared for these additional expenses.

- Work with Navarre Real Estate Source: Our seasoned real estate agents can offer invaluable guidance, assisting you in finding the perfect property and going toe-to-toe in negotiations. A knowledgeable loan officer will guide you through the mortgage application process and help secure the best loan for your circumstances.

Do you need a recommendation for home inspections, lenders, construction or even lawncare? Our team of real estate agents have great recommendations for you.

Embarking on the home buying journey can be stressful. However, with Navarre Real Estate Source, you can rest assured you will be treated like family. Using a trusted and experienced real estate agent, understanding different loan types and comprehending the nuances of the home buying adventure, you will be set up for success for owning your dream home.

Why Do You Need a Real Estate Agent?

Choosing the right real estate agent is a crucial decision when buying or selling your property. A skilled and reliable real estate agent can guide you through the complex process, offer our expert advice, negotiate on your behalf, and help you achieve your real estate goals. That is why you have the team at Navarre Real Estate Source.

Benefits of Choosing Navarre Real Estate Source

Expertise and Local Market Knowledge – One of the primary reasons to choose the right realtor is their expertise and in-depth knowledge of the local market. Our real estate agents will have extensive experience and understanding of the local Navarre (and surrounding) areas, local real estate trends, prices and inventory. We can provide you with valuable insights about the neighborhood, school districts, amenities, and future development plans.

Whether you’re searching for a home on the beach, a home in a great school zone, turnkey or a fixer upper, we have the knowledge to help you make informed decisions based on accurate and up-to-date information.

Negotiation Skills – Negotiating is an essential aspect of any real estate transaction. Our skilled real estate agents can advocate for your best interests and negotiate effectively on your behalf. We also specialize in helping military families buy or sell their homes quickly.

We have the expertise to analyze market conditions, assess property values, and craft strategic offers or counteroffers. By leveraging our top-notch negotiation skills, we can help you secure the best possible deal, whether you are buying or selling a property.

Access to Resources and Network – Realtors have access to a wide range of resources and networks that can significantly benefit their clients. With our connections with other professionals in the industry, such as mortgage brokers, home inspectors and contractors, you can rest assured you are in great hands. Our connections can streamline the process and ensure that you have access to reliable and reputable service providers.

Time and Effort Savings – Buying or selling a property involves numerous tasks, paperwork, and coordination. Our skilled realtors can handle these responsibilities on your behalf, saving you time and effort. We will schedule all property showings, handle negotiations and oversee the closing process.

Family is important and we understand the stress or buying or selling a home. By choosing Navarre Real Estate Source, you are able to focus on other aspects of your life while having peace of mind knowing that a professional is taking care of your real estate needs.

Mitigating Risks and Avoiding Pitfalls – With Navarre Real Estate Source, your homebuying experience is personal and handled with the upmost care. Real estate transactions can be complex and involve potential risks and pitfalls. Working with an experienced real estate agent can help you navigate these challenges and protect your interests. We can identify red flags in property listings, perform due diligence, and advise you on potential issues such as zoning restrictions, title concerns, or property defects. With our guidance we can help you avoid costly mistakes and ensure a smooth and successful transaction.

Emotional Support and Advocacy – The process of buying or selling a property can be emotionally charged and stressful. Navarre Real Estate Source’s trustworthy real estate agents can provide the necessary support and act as your advocate throughout the journey. We can offer objective advice, address your concerns, and provide reassurance during challenging times. Having a reliable professional by your side can alleviate stress, instill confidence, and make the entire experience more enjoyable.

Choosing the right agent is paramount for a successful and stress-free real estate transaction. Our expertise, negotiation skills, access to resources, and ability to mitigate risks can make a significant difference in achieving your goals. By selecting the right real estate agent, you are investing in a trusted partner who will guide you through the process and maximize your chances of a favorable outcome.

Our real estate agents offer comprehensive real estate services in the Navarre area. We provide expert guidance, market analysis, and negotiation assistance. Whether buying or selling, we are dedicated to helping our clients achieve their real estate goals efficiently and effectively. Contact us today to get started.

Northwest Florida Communities

Imagine waking up near the beautiful emerald waters and sugar-white sand of Northwest Florida. spend your days soaking up the sun’s rays and enjoying boating, fishing, kayaking or floating down the river. Northwest Florida has plenty to offer for your outdoor hobbies.

Northwest Florida Communities

Navarre and Gulf Breeze are beautiful communities on the Gulf Coast that offer the small-town look and feel you may be looking for.

Navarre is one of the fastest growing communities with a population of an estimated 45,000 people and is located about 25 miles from Pensacola and 15 miles from Fort Walton Beach. It is also located near the Naval Air Station of Pensacola, Hurlburt Field and Eglin Air Force Base, making this a hot spot for military service men and women. Named as “Florida’s Best Kept Secret”, this small town is waiting for you to call it home.

Gulf Breeze is located between Navarre and Pensacola with a population of just under 6,000 people. This beach-side community has multiple neighborhoods that are family friendly, including Tiger Point. Military bases are close by and easily accessible for service men and women.

Fort Walton Beach was incorporated in 1941 and has an estimated population of over 22,000 people. Nearby is the Destin-Fort Walton Beach Airport that serves much of the emerald coast. Okaloosa Island is a 3-mile island of Gulf of Mexico access. Much like Navarre and Gulf Breeze, Fort Walton Beach is just minutes from Hurlburt Field and Eglin Air Force Base. Northgate Estates is one of the prime neighborhoods locals and new arrivals strive to get into.

If you are looking for a family friendly community on the beautiful emerald coast, look no further than our beautiful area. Our team of real estate agents are here to help you find the perfect community for you and your family. Give us a call today to discuss your home wish list and needs. Let’s begin the search for your dream home!