- Call/Text: 850.987.HOME(4663)

- 1805 Alhambra St. Navarre, FL 32566

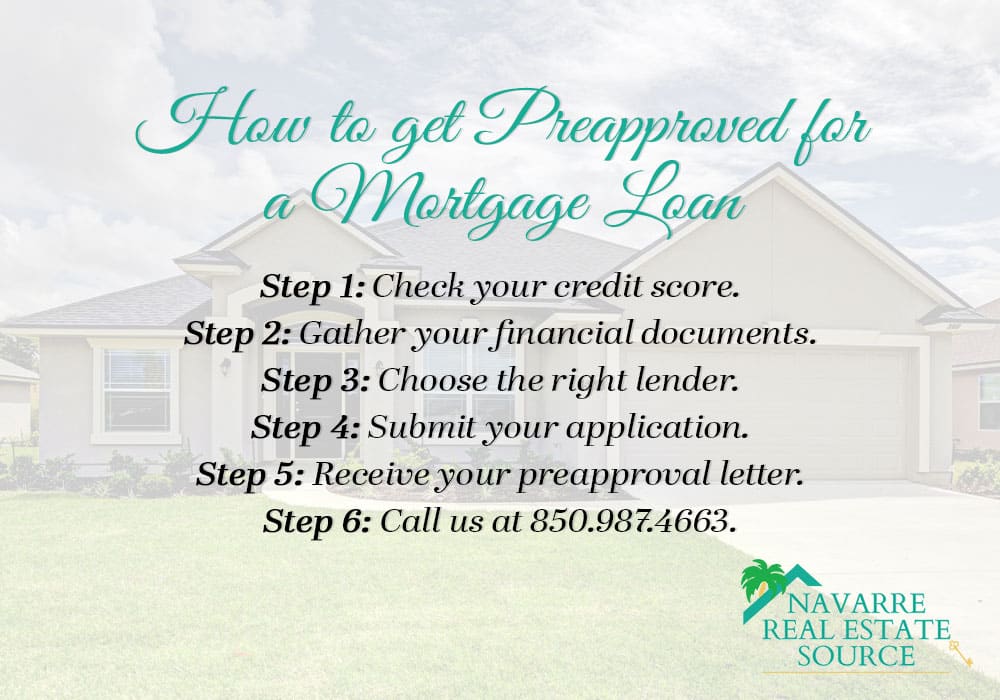

How to Get Preapproved for a Mortgage Loan: The Do’s and Don’ts

Securing a mortgage loan preapproval is a pivotal step in the home buying process.

Securing a mortgage loan preapproval is a pivotal step in the home buying process.

It not only gives you a clear understanding of your budget but also makes you an attractive buyer to sellers. In this comprehensive guide, we’ll walk you through the process of getting preapproved for a mortgage loan, highlight key dos and don’ts, and introduce you to local lenders in Navarre. Plus, we’ll show you how Navarre Real Estate Source’s team of agents can assist you in finding the perfect home in Navarre.

What is Mortgage Loan Preapproval?

Mortgage loan preapproval is an assessment by a lender that determines how much you are qualified to borrow before you even start house hunting. This involves a thorough evaluation of your financial status, including your credit score, income, assets, and debts.

Importance of Mortgage Loan Preapproval

Getting preapproved for a mortgage loan offers several benefits:

- Budget Clarity: Knowing your borrowing limit helps narrow down your home search.

- Stronger Offers: Sellers are more likely to consider offers from preapproved buyers.

- Faster Closing: With preapproval, the loan process can move more quickly once you find a home.

The Dos and Don’ts of Getting Preapproved for a Mortgage Loan

-

The Dos

- Do Check Your Credit Score: Before applying for preapproval, obtain your credit report and score. A higher credit score can lead to better loan terms.

- Do Gather Financial Documents: Prepare essential documents such as tax returns, pay stubs, bank statements, and proof of assets. Lenders will require these to verify your financial stability.

- Do Compare Lenders: Different lenders offer varying interest rates and terms. Shop around to find the best deal.

- Do Get Preapproved Early: Getting preapproved before you start house hunting gives you a clear idea of your budget and strengthens your offer.

-

The Don’ts

- Don’t Make Major Financial Changes: Avoid significant financial changes such as job switches or large purchases, as they can impact your creditworthiness.

- Don’t Apply for New Credit: Refrain from opening new credit accounts during the preapproval process to avoid negatively affecting your credit score.

- Don’t Hide Financial Information: Be transparent about your financial situation. Lying or hiding information can lead to denial of your loan.

Why Work with Navarre Real Estate Source’s Team?

After securing preapproval, the next step is finding your dream home. Navarre Real Estate Source’s team of experienced agents can help you navigate the local market. Their deep knowledge of the Navarre area ensures you’ll find a home that meets your needs and budget.

Frequently Asked Questions

- What is the difference between prequalification and preapproval? Prequalification gives you an estimate of how much you can borrow, while preapproval involves a more thorough evaluation of your finances and provides a conditional commitment from the lender.

- How long does the preapproval process take? The preapproval process typically takes a few days to a week, depending on how quickly you can provide the necessary documents.

- How long is a mortgage preapproval valid? A mortgage preapproval is usually valid for 60 to 90 days. After that, you may need to update your financial information with the lender.

- Can I get preapproved with bad credit? Yes, you can still get preapproved with bad credit, but your loan options may be limited, and you may face higher interest rates.

- What happens if my financial situation changes after preapproval? If your financial situation changes, such as a job loss or a significant new debt, inform your lender immediately, as it could impact your preapproval status.

- How can Navarre Real Estate Source help after I get preapproved? Navarre Real Estate Source’s team can assist you in finding the perfect home in Navarre, leveraging their local expertise and market knowledge to ensure a smooth home buying process.

Local Lenders in Navarre, Florida

When seeking preapproval, consider working with local lenders who understand the Navarre market:

Getting preapproved for a mortgage loan is a vital step in the home buying journey. By following the dos and don’ts outlined in our guide and working with local lenders in Navarre, you can streamline the process and position yourself as a strong buyer. Once preapproved, Navarre Real Estate Source’s team of agents can help you find the perfect home in this beautiful coastal community!